Restrictive Endorsement Stamps

In today’s world people are often surprised to find that at Rubber Stamp Champ we deliver very consistently on our promise. So many 5-Star reviews we receive express amazement that the stamp ordered was exactly what the person expected, that our customer service was very helpful and that they received their order fast, and often much sooner than they expected.

With the current need for restrictive endorsement stamps skyrocketing due to new government regulations, we identified that need immediately and to serve all those searching for the products, added five restrictive endorsement stamp choices to our website, making it easy for all those searching for these unique products to find and get exactly what they need from us.

Currently no other stamp maker is offering these important and very special products, and we are happy, once again, to not only meet customer expectations, but to exceed them.

A restrictive endorsement limits the use of a financial instrument. The result of a restrictive endorsement is that a financial instrument is no longer a negotiable instrument that can be passed from the stated payee to a third party. An example of a restrictive endorsement is the “For Deposit Only” stamp used by most companies on the back of a received check. This stamp effectively limits further action on the check by the stated payee to only being able to deposit it.

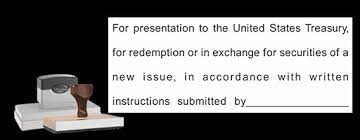

Currently, other forms of restrictive endorsement messages have come in to use, and if you are looking for one of these specific types of stamps we have several for you to choose from. Most notably, we offer rubber stamps for restrictive endorsements of U.S. Bearer Securities, Title 31, Part §328.5 and §328.6. We offer five versions of this endorsement stamp.

Restrictive Endorsement Stamps have been a part of financial transactions for a long time, and the example everyone is familiar with is the simple For Deposit Only message stamped on the back of a check, that restricts the check’s use to it’s deposit into that person’s bank account. This stamp effectively limits further action on the check by the stated payee to only being able to deposit it. In banking, a restrictive endorsement is the type of endorsement whereby the financial instrument or a check is limited to use by the payee (receiver). The restrictions or constraints highlighted on the check create the limitation placed on a restrictive endorsement.

An example restriction would be “pay to the order of the bank” or “For Deposit Only.” Such can be followed by the business name or the payee’s account number. In the cases of companies, such negotiable (check) instruments are endorsed by stamping at the back. Indicating “For Deposit Only” and stamping the check implies that the payee can only deposit the cash in their bank account, but not cash it out nor use the check for any other action.

Restrictive endorsements are commonly used to settle debt since they protect the debtor from future disputes with the creditors. This is because the outlined conditions tie the creditor upon cashing out the check, which means they have accepted the terms and amount of debt settlement. The restrictions also can be used to save the debtor during debt settlement disputes. Companies commonly use restrictive endorsements to improve the internal control of their assets.

A customer may send a supplier a check payment, on which is written the words “in full payment of account” or similar terms. This is not precisely a restrictive endorsement, since it is not restricting the further negotiability of the check. However, it may have a substantial impact on the ability of the supplier to obtain payment on any remaining unpaid balance on the customer’s account, since depositing the check may be considered acceptance of the terms added to the check. The decision process when you receive such a check is:

- Discuss the matter with legal counsel to see how it is impacted by applicable laws.

- If you were about to write off the account balance (thereby assigning zero value to the unpaid amount), then it probably makes sense to deposit the check and write off the remaining balance.

- If you intend to pursue full payment, then return the check to the customer. Do not deposit it.

If you use a bank lock box to deposit all incoming checks, then impose a procedure where the bank staff does not deposit any checks containing restrictive endorsements, and instead forwards them to the company for review.

At Rubber Stamp Champ, we have over 20 years of experience in creating custom stamps. We are your source for all your stamping needs! Have a question or need assistance ordering? Call our friendly customer service people weekdays at 800-469-7826 and we will help ensure you get the right stamp for your needs!